It’s still true: The only sure things in life are death and taxes. You can’t avoid the former, but you can minimize the latter. A good estate plan can preserve assets for your descendants, especially if you are married.

An estate plan, in this context, encompasses two legal documents needed to carry out your wishes: a will and trust. When you die, the will pours all assets held in your name into your trust(s). Essentially, the trust acts as a vessel, ready to hold assets in a way that optimizes available tax benefits.

Massachusetts and Federal Estate Tax Exemptions

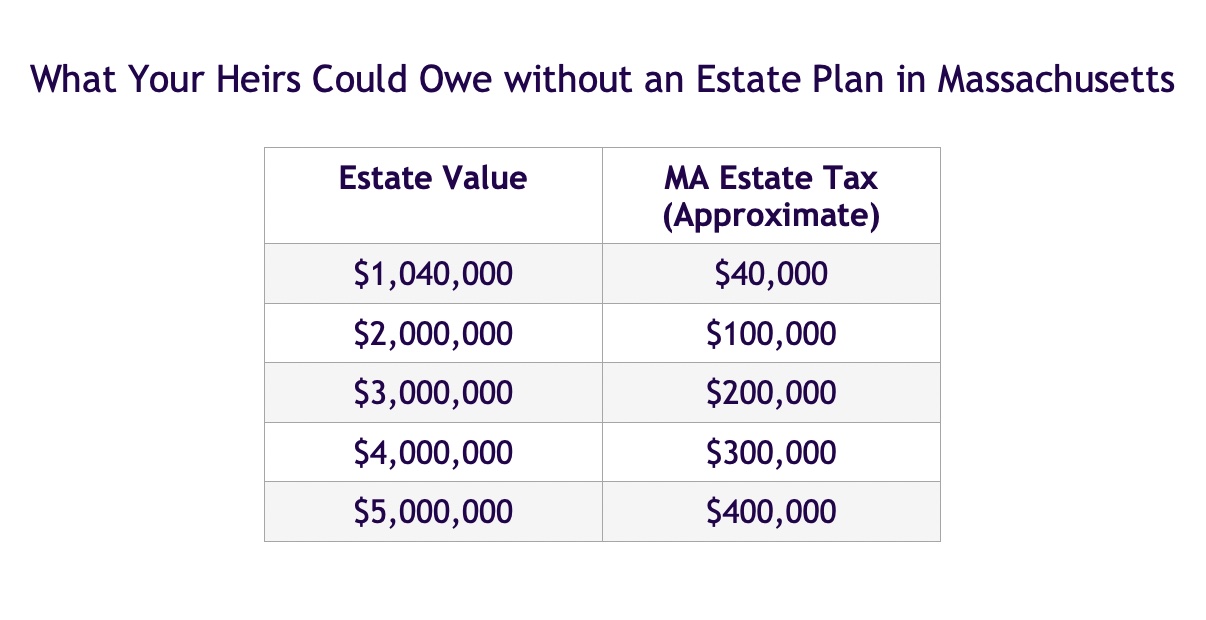

Even without an estate plan, a portion of your estate will be exempt from state and federal taxation. Massachusetts estates valued below $1 million are not taxed. Uncle Sam is far more generous, especially to wealthy couples. Estates valued below $12,920,000 for a single person, and below $25,840,000 for a married couple, are fully exempt.

Massachusetts has one of the smallest estate tax exemptions in the nation. The Massachusetts House of Representatives recently passed a bill to double the Massachusetts estate tax exemption to $2 million. The bill has not yet passed the Senate, however.

Deferrals, Deductions, and Exemptions

When one spouse dies, any property left to the surviving spouse is exempt from taxes (the “marital deduction”). Married couples can defer their estate tax liability until the surviving spouse’s death via the state and federal unlimited marital deduction.

What if there is no estate plan in place for a married couple? When the surviving spouse dies (or if both spouses die at the same time), the estate must pay taxes on the total family assets that exceed the exemption. The same holds true for a single individual’s estate.

That’s why estate planning is crucial to eliminate or reduce estate tax liability.

Preserve Your Assets for the Next Generation with a Trust

An estate plan for a married couple, in its simplest form, includes two types of trusts—a Marital Trust and a Family Trust. The Marital Trust holds the minimum total assets that qualify for the unlimited marital deduction, in order to eliminate or reduce the state or federal estate tax. Assets equal to the state exemption are segregated in a Family Trust.

For example, a married couple in Massachusetts with children, Morticia and Gomez, own assets totaling $3 million in their combined taxable estates. Gomez dies, leaving Morticia with $3 million in assets, which is their combined net worth. She owes no estate taxes upon his death, thanks to the deferral of estate tax with the unlimited marital deduction.

If Gomez does not have a will and trust, however, Morticia’s estate worth $3 million will have to pay approximately $200,000 in estate tax before her beneficiaries (Wednesday, Pugsley, Uncle Fester, Grandmama, Lurch, and Cousin Itt) inherit anything.

By contrast, with proper estate planning, the couple can significantly reduce their estate tax and preserve more for their beneficiaries. The trustee funds Gomez’s Marital Trust with $2 million, leaving $1 million in the Family Trust, which will not be included in the taxable estate. Morticia’s taxable estate will now be $2 million, saving $100,000 in estate taxes upon her death by simply creating an appropriate estate plan.

At Mountain Dearborn, our estate planning specialists design trusts that evolve with revisions in tax law. Any changes to federal or Massachusetts exemption thresholds will be accounted for. If you need legal guidance for estate planning, please contact us to learn more.

Image: “Addams Family main cast 1964,” Wikimedia Commons