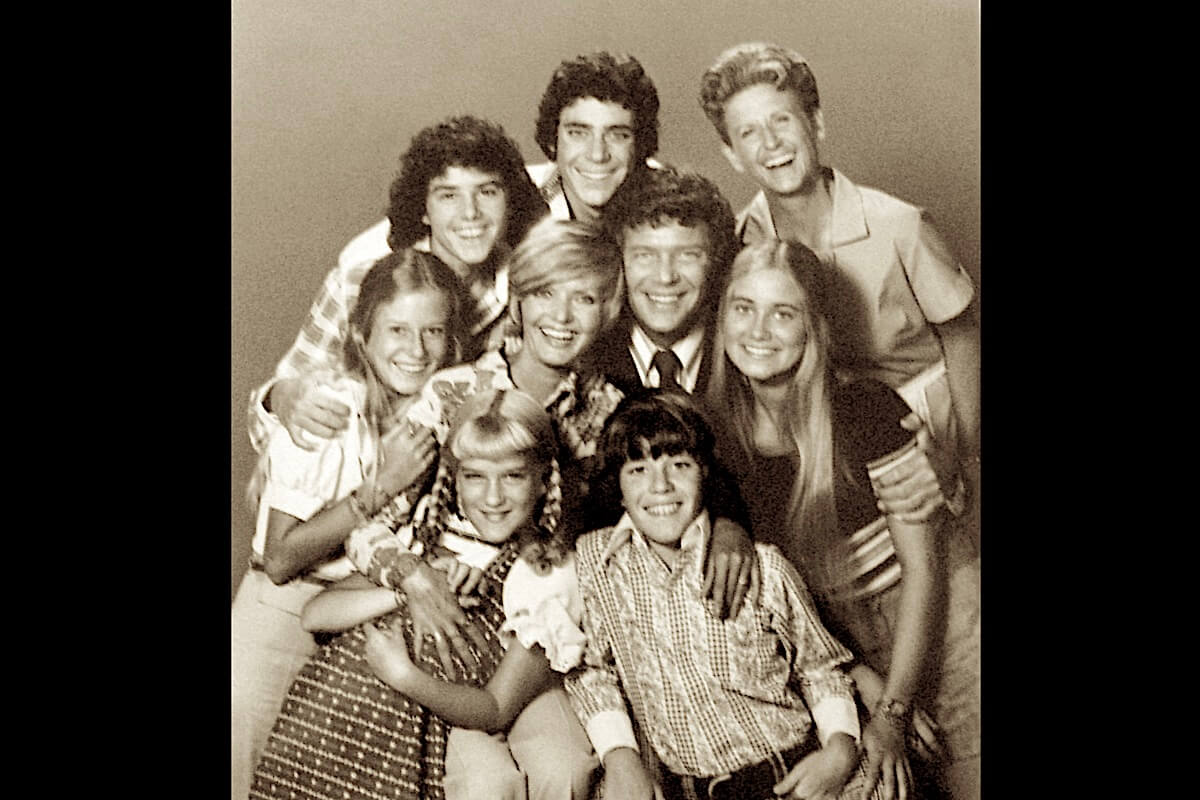

Remember The Brady Bunch? The ABC family sitcom about the foibles of a blended family with six children (“Marcia, Marcia, Marcia!”) that aired from 1969-1974 became even more popular in syndication. Today, you can relive all the ’70s nostalgia on streaming services. Growing up, I watched the show regularly, long before Nickelodeon dominated kids’ TV.

So it’s no wonder, as I’ve been reviewing the new federal child tax credit, that the Brady family came to mind. With their six children, Mike and Carol Brady could have benefited greatly from today’s child tax credit. In fact, the Bradys could have claimed a tax credit of $18,000 – or even more if Cindy and Bobby were younger than six.

To understand how the credit works, here are some basic Qs & As:

1. What is a tax credit?

A tax credit reduces the tax you owe dollar-for-dollar, like an instant rebate. If you owe a tax of $1,000 and you have a $400 credit, your new tax is $600. A credit differs from a tax deduction, which reduces how much of your income is subject to tax.

2. What is the child tax credit?

Basically, parents get a tax credit for each child, up to age 18.

3. How did the American Rescue Plan Act of 2021 change the child tax credit?

ARPA expands the tax credit in four ways:

- The law adds 17-year-old children as qualified children.

- For many families, the law increases the prior tax credit from $2,000 to $3,000 for children aged 6 to 17 ($3,600 for children under the age of 6).

- The child tax credit is now fully refundable for qualifying families (those who lived in the U.S. for more than six months during 2021). “Refundable” means that a family can receive a refund check depending on the amount of tax it owes. For example, suppose a parent owes $2,800 in taxes and qualifies for a $3,000 refundable credit. Under the new law, $2,800 of the $3,000 credit would be used to pay the tax bill, and the parent would receive a $200 refund.

- The new law was designed to provide immediate financial help to eligible families. For that reason, the Internal Revenue Service did not wait for families to file their 2021 tax returns. Instead, the IRS made monthly child tax credit payments from July 2021 to December 2021 as advance payments of the child tax credit that parents were expected to claim on their 2021 tax returns. (The advance payments were based on parents’ 2020 tax returns.) A parent who received all six of the advance payments in 2021 may claim the other six payments on his or her 2021 tax return. A parent who received excess child tax credit payments, however, probably will be required to return the overpayment, or some of it.

4. Can all parents claim the higher tax credit of $3,000 or $3,600 on their 2021 tax returns?

No. The increased tax credits phase out at modified adjusted gross incomes (AGIs) of $75,000 for single filers, $112,500 on head-of-household returns, and $150,000 on joint returns. The credit decreases by $50 for each $1,000 of modified AGI over the threshold in question.

For example, suppose a married couple, filing jointly with a modified AGI of $170,000 for 2021, has one child who is five years old. The full credit for the child is $3,600. But their AGI exceeds the $150,000 threshold by $20,000. Because the credit is reduced by $50 for each $1,000 above $150,000, the couple’s net credit drops from $3,600 to $2,600.

Families whose income levels exceed the preceding thresholds, but have modified AGIs at or below $400,000 on joint returns or $200,000 on other returns, can claim a credit of $2,000 per child, less the amount of any advance payments they received ((the Child Tax Credit will not be reduced below $2,000 per child unless parents’ AGI exceeds $400,000 for married and filing jointly or $200,000 for all other filers.).

Parents will have many questions during this tax season: Can I claim a tax credit for a child born in 2021? What if I share custody of my kids? What should I do if didn’t receive advance payments but was eligible to receive them? If I did receive advance payments, how do I treat them on my 2021 return?

I’ve focused on the basics, here, but the child tax credit involves very specific, technical criteria. If you contact me with your questions, I will be pleased to advise you.

Image: The Brady Bunch via Wikimedia Commons.